I’m Ekam — currently between things, mildly bored, and overly caffeinated — so I figured why not start sharing stuff I actually enjoy?

Before we dive into my ninth post, here’s my story in five words:

Startups. Consumer/Food. Personal Finance. Chess. Sports.

That’s the vibe. If you’re into any of those, stick around.

The other day, I bought a pack of Orbit gum, and something felt… off. It had the same crisp, familiar packaging. It cost the same ₹5 I’ve paid for what feels like a lifetime. But when I popped it open, I noticed something strange. Instead of the usual six pieces, there were just three.

For a moment, I thought I was imagining it. But I wasn’t.

It’s easy to shrug this off. It’s just gum, after all. But this small, quiet change is a symptom of a much larger story:- a story about the invisible pressures shaping our world and the silent bargains brands are making to survive.

What I’d stumbled upon has a name: shrinkflation. In this piece, I have tried to break down exactly what it is, why it happens, how it works on our psychology, and the high price of its hidden costs.

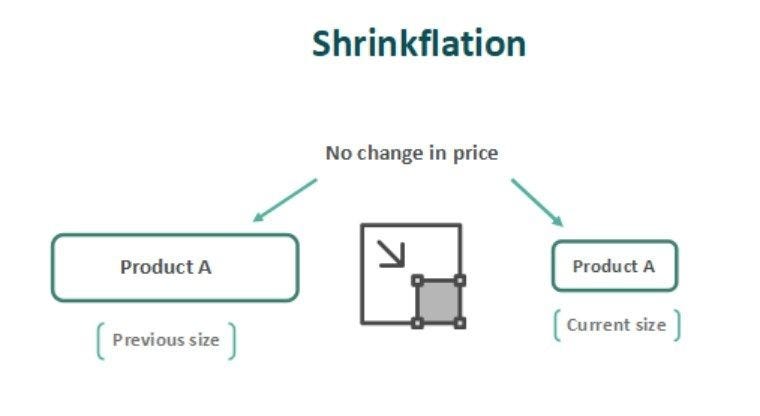

What is Shrinkflation?

In the simplest terms, shrinkflation is a corporate magic trick.

It's the practice of reducing the size or quantity of a product while the price remains the same. You pay the same, but you get less. It’s a form of hidden inflation, hiding in plain sight on every grocery aisle.

You'll see it everywhere once you start looking:

That "family size" bag of chips that seems to be more air than snack.

The ice cream tub with a new, cleverly concave bottom, stealing precious volume.

The toilet paper roll with a wider cardboard tube, meaning fewer sheets for the same price.

The detergent bottle that looks identical but empties just a little bit faster.

This isn't an accident. It’s a deliberate, calculated decision. Here’s why it’s made.

The Grip on Margins: A Business Breakdown

Companies don't do this just to be sneaky; they do it as a response to intense financial pressure. This pressure comes from two primary sources:-

A) The Rising Tide of Costs

External Pressures: The world gets more expensive. This includes the rising costs of raw materials (like cocoa or wheat), fluctuating energy prices to run factories, and tangled supply chains that make logistics a nightmare.

Internal Pressures: Success itself creates costs. To reward a hard-working team and retain talent, a company might give a salary boost. It’s the right thing to do, but it’s an internal cost that eats directly into the profit margin of every item sold.

B) The Price-Hike Dilemma

When costs rise, a company has two main choices:

Raise the Price: This is the honest route, but it’s psychologically jarring for customers. We notice price hikes instantly and react strongly. It can trigger backlash and send shoppers running to cheaper competitors.

Reduce the Quantity (Shrinkflation): This is the stealthy route. The company bets that most of us won’t notice a few fewer grams or a slightly smaller bottle.

From a pure risk-management perspective, shrinkflation often feels like the safer bet to protect a business from evaporating profits.

The 'How': The Psychology That Makes It Work

Shrinkflation is effective because it exploits a fundamental quirk in our thinking.

We Have Strong Price Anchoring: Our brains "anchor" to familiar prices. A ₹5 pack of gum is a powerful mental shortcut. If that price suddenly becomes ₹6, the anchor breaks and our internal alarms go off.

We Have Weak Quantity Perception: We are far less skilled at noticing gradual changes in volume or weight. Unless the change is drastic, it slips right under our cognitive radar.

The simple truth is: We react viscerally to a change in price, but we adapt silently to a change in quantity. Brands know this, and they use it.

In one famous example, Dannon used to sell yogurts in larger containers than its competitor Yoplait — eight ounces versus six. Consumers were convinced that Dannon’s yogurt was more expensive, not picking up on the fact that it was simply bigger. Eventually, Mr. Gourville said, the company caved and shrank its packaging.

“Sales of Dannon’s yogurt, which declined immediately after the size reduction, have since rebounded,” The Times reported in 2003. “And Dannon is now pocketing a larger profit on every cup of yogurt it sells.”

The Hidden Cost

While shrinkflation solves a short-term margin problem, it creates a much more dangerous long-term one: the erosion of trust.

Eventually, we do notice. And when we do, it doesn’t feel like smart economics. It feels like a betrayal. The brand you once loved starts to feel sneaky, like it was hoping you were too distracted to notice you were being short-changed.

In an age where trust is a brand's most valuable asset—the latest Edelman Trust Barometer found 80% of people trust brands more than government or media—this is a fire you don’t want to play with. Trust is the invisible moat that keeps a customer loyal. Shrinkflation risks poisoning that well, forever.

The Alternative

Courageous brands are choosing a different path. Instead of hiding the change, they explain it, treating their customers as intelligent partners.

What This Looks Like:

"Our chocolate bar is now 90g instead of 100g. In the last year, cocoa prices went up 18%. We faced a choice: use cheaper ingredients or slightly reduce the size. To protect the quality you love, we chose the latter."

Why This Works:

This approach replaces the feeling of being tricked with a feeling of being respected. Customers may not love getting less, but they appreciate the honesty. It’s an adult conversation that builds the kind of loyalty that lasts, fortifying the trust that shrinkflation so easily breaks.

TLDR

Shrinkflation isn’t evil. It’s a logical, if cynical, response to a volatile economic world. It’s a strategy that makes perfect sense, right up until the moment it doesn’t.

Margins matter. But so does trust.

And the smartest brands are realizing that one of those is far, far easier to fix than the other. Because the only thing that feels worse than getting fewer chips in the bag… is feeling like you weren’t supposed to know why.

What do you think? Have you noticed shrinkflation in your own shopping? Leave a comment below.

I remember the first time it hit me: I was picking up my favorite Sara Lee Bagels from Costco. I thought someone had stolen one from the pack only to realize all the packs had gone from 6 to 5. It wasn’t a thief. It was Sara Lee who stole my bagel.